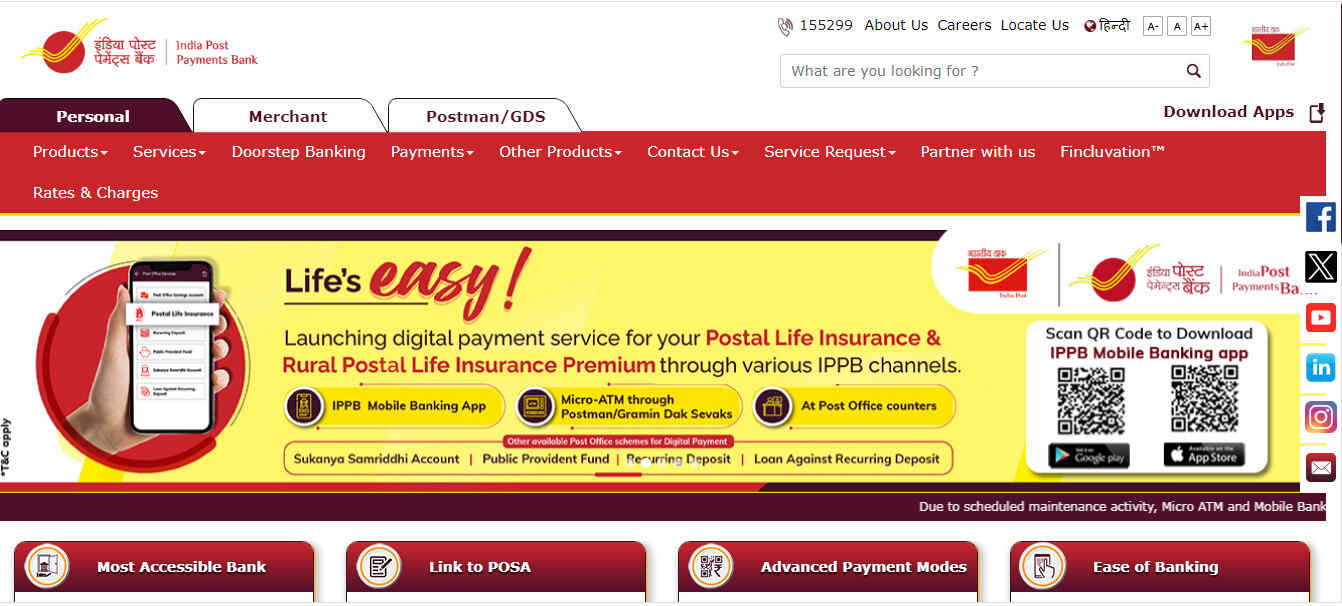

India Post Payments Bank: India Post Payments Bank (IPPB) is an initiative by the Government of India to provide accessible and affordable banking services to the unbanked and underbanked population of the country.

Launched in 2018, IPPB leverages the vast network of post offices across India to deliver financial services to every nook and corner of the country.

In this article, we will explore the various services offered by IPPB, its benefits, and how it is transforming the banking landscape in India.

Key Features and Services of IPPB

IPPB offers a variety of features and services designed to meet the needs of its customers:

- Savings Accounts: IPPB provides different types of savings accounts, including regular savings, digital savings, and basic savings accounts.

- Money Transfers: Customers can easily transfer money domestically using IPPB’s platform, including NEFT, RTGS, and IMPS services.

- Bill Payments: IPPB allows customers to pay utility bills, recharges, and other payments conveniently.

- Insurance Products: IPPB offers various insurance products in collaboration with leading insurance companies.

- QR Card: IPPB issues a unique QR card that enables hassle-free and secure transactions without the need for remembering account numbers or passwords.

India Post Payments Bank

India Post Payments Bank (IPPB) is a public sector bank under the Department of Posts, Ministry of Communications, Government of India.

IPPB aims to make financial services more accessible to rural and remote areas by utilizing the extensive network of post offices and postal workers.

It offers a range of banking and financial services, including savings accounts, remittances, insurance, and more.

| Attribute | Details |

| Full Name | India Post Payments Bank (IPPB) |

| Type | Insurance & Banking Service Company |

| Founded | 17 August 2016 |

| Launched | 2018 |

| Headquarters | New Delhi, India |

| Owner | India Post, Department of Post, Ministry of Communications, Government of India |

| Key People | Vineet Pandey (Secretary, Department of Posts) |

| Customers (as of March 2024) | 90+ Million Customers |

| Customer Service | 155299 |

Read also: OPSC Prelims Result 2025 Out: Check & Download PDF @opsc.gov.in

Benefits of Banking with IPPB

Banking with IPPB offers several advantages:

Accessibility:

With over 1.5 lakh post offices and 3 lakh postal workers, IPPB ensures that banking services reach even the most remote areas of India.

Affordability:

IPPB provides low-cost banking solutions, making it affordable for people from all economic backgrounds.

Convenience:

IPPB’s digital platform and doorstep banking services make it convenient for customers to access banking services without visiting a branch.

Financial Inclusion:

IPPB plays a crucial role in promoting financial inclusion by bringing the unbanked population into the formal banking system.

How to Open an Account with IPPB?

Opening an account with IPPB is a straightforward process:

- Visit the nearest post office or contact a postal worker.

- Provide your Aadhaar card and other necessary documents for KYC verification.

- Fill out the account opening form and submit it along with the required documents.

- Once your KYC is verified, your account will be activated, and you will receive your account details and QR card.

The Future of IPPB

IPPB is continuously evolving to enhance its services and reach more customers. Some of the future initiatives include:

- Expanding Digital Services: IPPB aims to introduce more digital banking services and mobile banking solutions.

- Collaborations: IPPB plans to collaborate with more financial institutions and service providers to offer a wider range of products.

- Financial Literacy: IPPB is working on initiatives to promote financial literacy and awareness among its customers.

FAQs

Is India Post Payments Bank a bank?

India Post Payments Bank (IPPB) is a reliable, affordable, and accessible bank for the common man.

How to check IPPB balance?

Send an SMS to 7738062873 to access IPPB’s SMS Banking services.

How do I send SMS to 7738062873?

Type ‘REGISTER’ and send it to 7738062873 from your registered mobile number.

Can I get an ATM card for an IPPB?

Yes.

Conclusion

India Post Payments Bank (IPPB) is a game-changer in the Indian banking sector, bringing financial services to the doorstep of every Indian.

With its extensive network, affordable solutions, and customer-centric approach, IPPB is making banking more accessible and inclusive.

Whether you are in a bustling city or a remote village, IPPB ensures that you have access to essential banking services, empowering you to manage your finances efficiently.