Paytm Payment Bank: In a world that is increasingly moving towards digital solutions, Paytm Payment Bank stands out as a pioneer in the field of digital banking and payment services.

Established with the vision of offering seamless and efficient banking experiences, Paytm Payment Bank has revolutionized the way we think about traditional banking.

In this article, we will delve into the features, benefits, and services provided by Paytm Payment Bank, and explore how it is transforming the banking landscape.

- Name: Paytm Payments Bank.

- Founded: 28 November 2017.

- Founder: Vijay Shekhar Sharma.

- Headquarters: Noida, India.

- License Received: 2017 (Payments Bank License).

- Launch Date: November 2017.

- Scheduled Bank Status: 2021.

- Parent Organization: Paytm.

- Customer Service: 0120 445 6456.

- Official Website: paytm.com.

Paytm Payment Bank

Paytm Payment Bank is an Indian financial institution that offers a variety of banking and payment services.

Unlike traditional banks, Paytm Payment Bank operates entirely online, providing customers with the convenience of managing their finances from the comfort of their homes.

Launched in 2017, Paytm Payment Bank is a subsidiary of Paytm, a leading digital payment platform in India.

| Attribute | Details |

| Name | Paytm Payments Bank |

| Founded | 28 November 2017 |

| Founder | Vijay Shekhar Sharma |

| Headquarters | Noida, India |

| License Received | 2017 (Payments Bank License) |

| Launch Date | November 2017 |

| Scheduled Bank Status | 2021 |

| Parent Organization | Paytm |

| Customer Service | 0120 445 6456 |

| Official Website | paytm.com |

Main Features and Services

Zero Balance Accounts:

Paytm Payment Bank offers zero-balance savings accounts, meaning customers are not required to maintain a minimum balance. This feature is particularly beneficial for individuals who want to avoid the penalties associated with falling below a minimum balance threshold.

Digital Transactions:

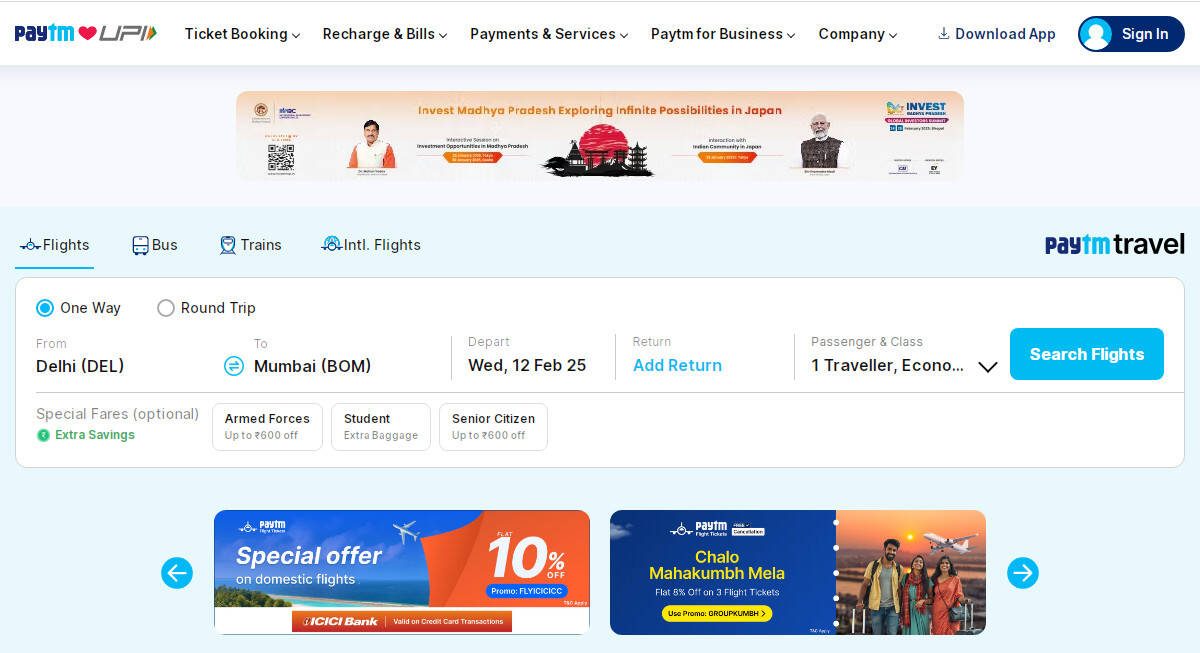

Customers can perform a wide range of digital transactions, including fund transfers, bill payments, and online shopping. The integration with the Paytm app makes these transactions seamless and efficient.

Interest on Savings:

Paytm Payment Bank provides interest on the savings account balance. This ensures that customers’ money not only remains safe but also grows over time.

Convenient Deposits and Withdrawals:

Customers can deposit and withdraw money at any Paytm KYC (Know Your Customer) point, ensuring easy access to their funds.

Online Banking Services:

The bank offers a user-friendly online banking portal and mobile app, enabling customers to manage their accounts, view transaction history, and access various banking services at their fingertips.

Benefits of Using Paytm Payment Bank

Accessibility:

With its fully digital platform, Paytm Payment Bank provides 24/7 access to banking services, making it convenient for users to manage their finances anytime, anywhere.

Security:

Paytm Payment Bank employs robust security measures to protect customers’ financial data and transactions. This includes encryption, multi-factor authentication, and regular security audits.

Cost-Effective:

The absence of traditional banking fees, such as minimum balance charges and transaction fees, makes Paytm Payment Bank an affordable option for customers.

Integration with Paytm Ecosystem:

Customers can seamlessly integrate their Paytm Payment Bank accounts with other Paytm services, such as Paytm Wallet and Paytm Mall, providing a unified and comprehensive digital experience.

Read also: Jio Payments Bank: Services, Features & How to Open an Account?

How to Open an Account?

Opening an account with Paytm Payment Bank is a simple process. Here are the steps:

Download the Paytm App:

Install the Paytm app from the Google Play Store or Apple App Store.

Complete KYC:

Follow the in-app instructions to complete the KYC process, which involves verifying your identity with valid documents.

Create an Account:

Once KYC is completed, you can create a Paytm Payment Bank account within the app.

Start Banking:

Begin using your new account for various banking and payment services.

FAQs

Can I open a Paytm payment bank account?

Any Indian resident without an existing BSBDA can open a BSBDA with Paytm Payments Bank.

Which country of Paytm?

Noida, India.

Can I transfer money to Paytm Payments Bank?

After March 15, 2024, you cannot deposit or add money to your Paytm Payments Bank Account/Wallet.

What type of payment is Paytm?

digital wallet payment solution.

Conclusion

Paytm Payment Bank is reshaping the banking industry by offering innovative and customer-centric services.

With its emphasis on digital convenience, security, and cost-effectiveness, it has become a popular choice for individuals seeking a modern banking experience.

Whether you are looking to open a savings account, perform digital transactions, or integrate with other Paytm services, Paytm Payment Bank provides a comprehensive solution for all your banking needs.